Allocate Overhead Cost Formula

This is the monthly percentage you must pay for overheads. This means that the.

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Accounting questions and answers.

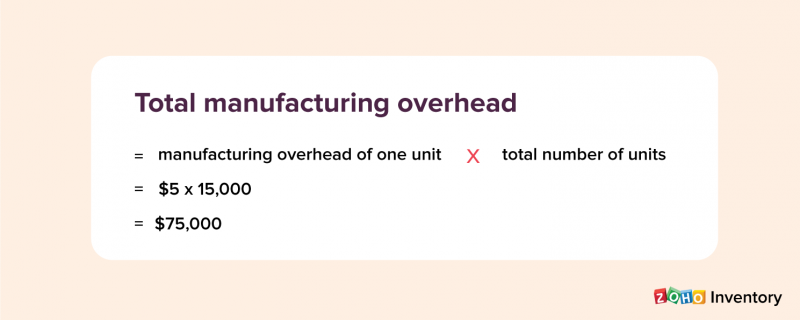

. The formula is as follows. Fixed overhead cost per unit 5 hours per tire x 6 cost allocation rate per machine hour Fixed overhead cost per unit 3. An allocation base can be a quantity such as machine hours that are used kilowatt.

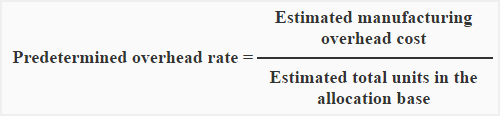

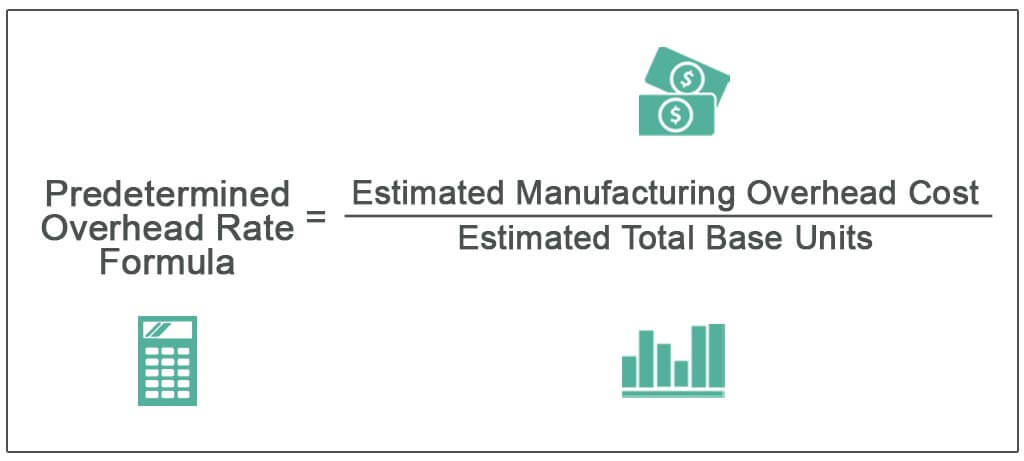

Predetermined overhead allocation rate x Actual quantity of the allocation base used OB. For example if the total overhead for making a product is 500. In this case divide your monthly overhead costs by your total monthly sales.

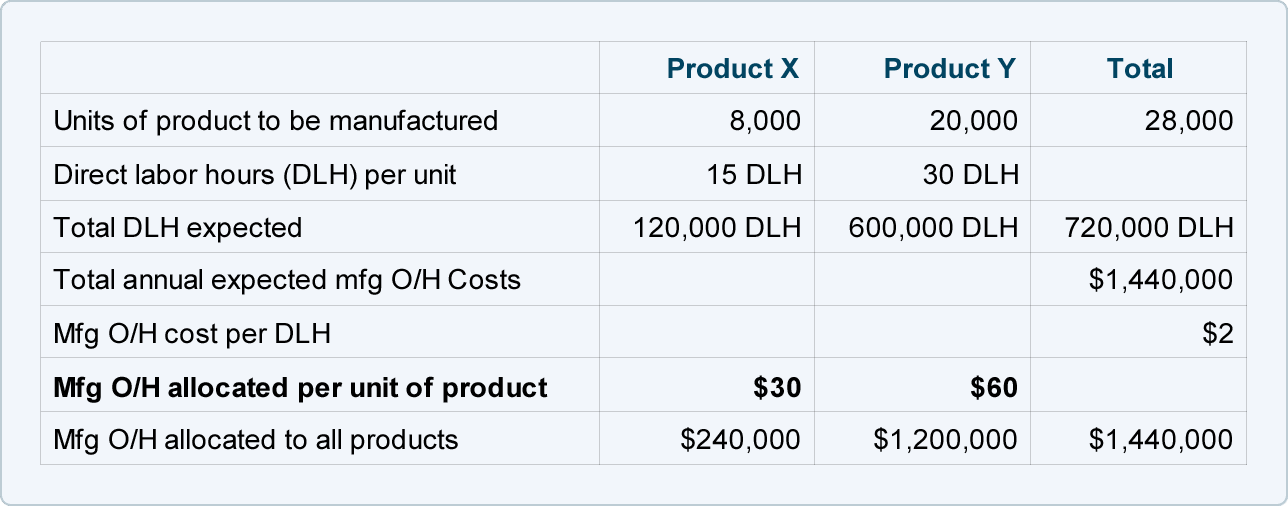

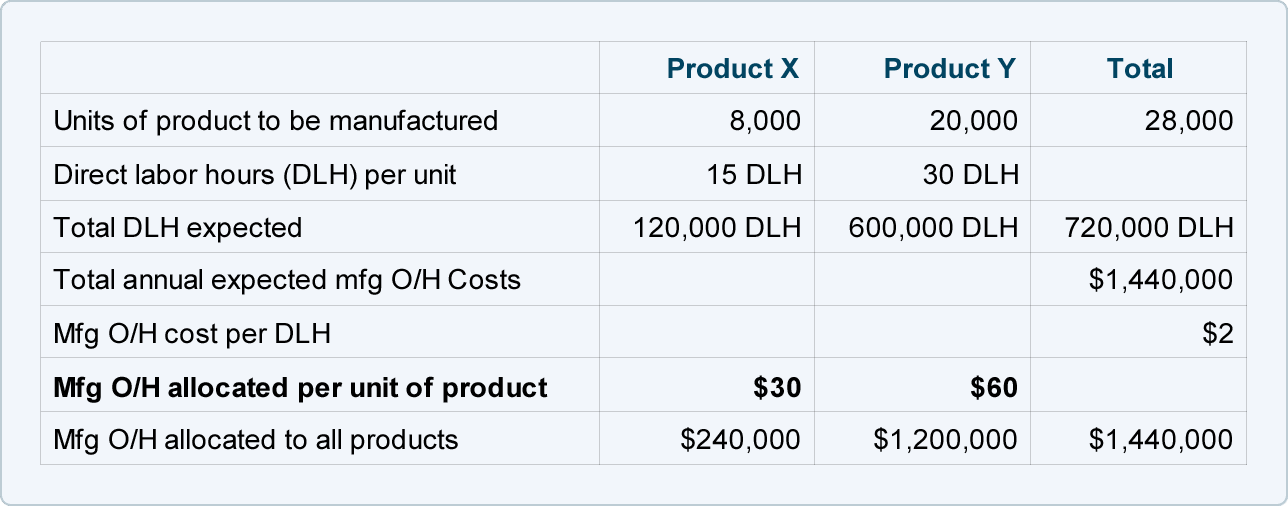

This is done by dividing total overhead by the number of direct labor hours. The standard overhead cost formula is. When setting costs and making budgets you should know the percentage of funds dedicated to overheads.

To calculate the overhead costs compared to sales divide the. Indirect Cost Activity Driver Overhead Rate Lets say your business had 850000 in overhead costs for 2019 with direct labor costs. Some expenses provide benefit to multiple activities so they should be allocated to more than.

For example if your company has 80000 in monthly. Predetermined OH allocation rate Actual aty of the allocation base used Allocated mig. Net Interest Income Rs 10000.

This is called the overhead allocation rate. The Allocation class is a part 1 of 2 phase of preparing the financial statements. Each tire has direct costs steel belts tread.

So if your total overhead cost per product is 50 and an employee works two hours to manufacture one such unit the allocated manufacturing overhead would be. An allocation base is the basis on which Cost accounting allocates overhead costs. After learning how to conduct cost-volume-profit analyses were ready to discuss cost allocation and the different types of systems we can use.

Hence Overhead Ratio using formula can be calculated as. 50 2. In that case the monthly overhead costs are divided by the monthly labor costs and multiplied by 100.

In order to calculate your overhead costs you would take your overhead costs which are 2075 and divide them by your sales for the period which total 32000. The overhead rate for the molding department is 6 per machine hour. By selecting the formula to allocate overhead OH costs.

Overhead Ratio Operating Expenses Operating Income. And to get the overhead rate. What is the formula to allocate overhead costs.

The typical procedure for allocating overhead is to accumulate all manufacturing overhead costs into one or more cost pools and to then use an activity measure to apportion. To compute the overhead rate divide your monthly overhead costs by your total monthly sales and multiply it by 100. To allocate manufacturing overhead costs the formula is O A.

Operating Expenses Rs 25000. Overhead rate is a cost allocated to the production of a product or service.

Predetermined Overhead Rate Formula Explanation And Example Accounting For Management

Predetermined Overhead Rate Formula How To Calculate

Indirect Cost Calculation And Process About Ala

Traditional Methods Of Allocating Manufacturing Overhead Accountingcoach

Predetermined Overhead Rate Formula Calculator With Excel Template

Job Costing Full Example Of Overhead Cost Allocation And Overhead Rate Calculation Youtube

0 Response to "Allocate Overhead Cost Formula"

Post a Comment